Are We There Yet?!? Crossing the Threshold into Thresholds-Based Thinking and Action

r3.0 launches a multi-pronged campaign to transcend incrementalism headlined by a Global Thresholds & Allocations Network

By Bill Baue and Ralph Thurm

The thing about tipping point thresholds is that you only discover where they are… by crossing them; until then, they remain uncertain and potential, not yet actual. Those of us who define sustainability vis-à-vis respect for ecological and social thresholds have been doing all we can for 2+ decades to amass the magic critical mass of support necessary to trigger a social tipping point from the status quo of incrementalism to a new mindset and paradigm based on broad recognition of both beneficial and adverse thresholds.

Just as young kids ask from the back seat on a long car trip, so too do we wonder: Are we there yet?!? Our answer at r3.0: a tentative yes.

And we’re helping build momentum by curating a multi-pronged campaign this year focused on transcending incrementalism (landing page to follow, see more details below). The most exciting aspect of this campaign is its flagship initiative: the launch of a Global Thresholds & Allocations Network (GTAN), thanks to generous funding support. GTAN will gather some of the key players actively working on thresholds & allocations (Ts & As) into field-building efforts to create a governing Commons for Ts & As (so of course, we’re employing the work of Economics Nobel Laureate Elinor Ostrom via Prosocial facilitation).

But before we go deeper on the campaign, let’s first set the stage. To understand the building momentum, we must understand the dual-directional dynamics: repelling forces (the increasing abandonment of incrementalism, exemplified by the practice of ESG) and attracting forces (the rising embrace of Context-Based Sustainability (CBS), a normative, open approach to respecting thresholds by applying allocations).

Repelling Forces: Abandoning Incrementalist ESG

The term “incrementalism” has emerged over the past decade or so to describe action on environmental and/or social issues that advances by increments that are, by definition, insufficient to achieve sustainability. Too little, too late encapsulates incrementalism. As r3.0 Advocation Partner Gil Friend recently pointed out, sustainability efforts also typically advance by increments; the difference is that these increments are measured vis-à-vis ecological and thresholds & allocations to ensure they are sufficient to achieve sustainability. Enough, in time encapsulates normative sustainability.

Last year witnessed a string of prominent defections from ESG orthodoxy (borrowing from the searing script written by Lorraine Smith two years earlier):

- Former Blackrock CIO for sustainable investing Tariq Fancy published a “secret diary” that outed ESG as akin to “selling wheatgrass to a cancer patient.”

- Former Generation Investment Management Partner Duncan Austin characterized ESG as a “voluntary market-led strategy” that’s ultimately a “fix that fails.”

- Former Timberland COO Ken Pucker asserts that ESG is a “trillion dollar fantasy,” noting that most ESG investing delivers little to no social or environmental impact.”

- Former Group Sustainability Officer Desiree Fixler was fired for whistleblowing that its ESG products were sold on misleading claims.

These exposés revealed that ESG, which had been evolving in practice into a kind of social norm (simply because “everyone is doing it”), is not, in fact, based on scientific or ethical norms. In other words, ESG is not a “normative norm,” while bona fide sustainability is — CBS is predicated on duties and obligations to manage impacts respecting the carrying capacities of vital capital resources that rightsholders rely on for their wellbeing.

We at r3.0 have also long exposed the shortcomings of ESG and other incrementalist regimes, acting as “norm entrepreneurs.” As Ellen Quigley of the University of Cambridge Centre for the Study of Existential Risk notes, “[o]nce these norm entrepreneurs have succeeded in convincing enough people, the norm achieves a ‘threshold or tipping point’.” Sound familiar?

r3.0 Managing Director Ralph Thurm pursued his norm entrepreneurship in his Lighthouse Keeper series of nine articles on what he dubbed “ESG LaLaLand” on Linkedin (now available as a newsletter to subscribe to monthly updates); r3.0 also bundled four earlier articles on Linkedin into an Opinion Paper on The Big Sustainability Illusion (that has now garnered 75k+ readers). r3.0 Senior Director posted a “Dear ESG folks” letter asserting that “we’ve reached an inflection point, in the wake of the Bloomberg Businessweek ‘ESG Mirage’ article that pierced the veil, revealing that the ESG emperor is naked.” This post has been viewed 37k+ times, liked 400+ times, commented on 182 times, shared 46 times, and reprinted (in an expanded form) on Impact Entrepreneur, where it is in the top 10% of views amongst its 100+ articles.

These, and many, many other developments, have consistently chipped away at the predatory delay of incrementalist ESG, which makes the business case for sustainability (prioritizing profit) instead of making the sustainability case for business (prioritizing wellbeing). “What is predatory delay, you ask?” tweeted the coiner of the term, futurist Alex Steffen.

Attracting Forces: Embracing Thresholds-Based Thinking & Action

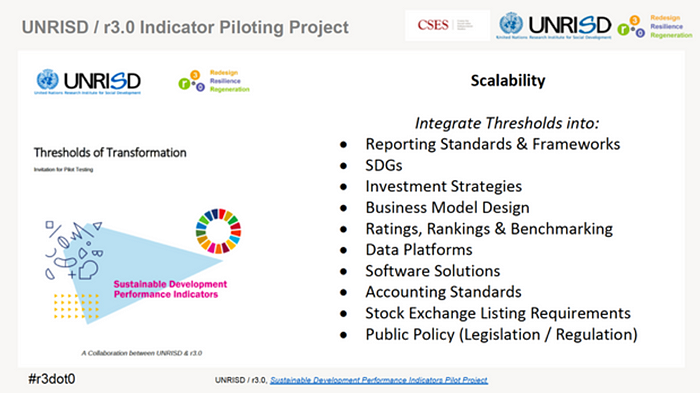

The biggest indicator of the rising embrace of thresholds-based thinking & action came late in the year, when the Impact Management Platform (IMP) — a network of all the major sustainability standard setters — unveiled a new website with a standalone page devoted to thresholds & allocations that explains just how to apply these necessary elements of sustainability measurement, management, and reporting. We at r3.0 applauded this move, which resulted in large part due to its participation in the piloting of a set of thresholds-based (and transformation-based) sustainability indicators in a project hosted by the United Nations Research Institute for Social Development (UNRISD) and managed by r3.0 (with support from our Advocation Partner, the Center for Sustainable Organizations.)

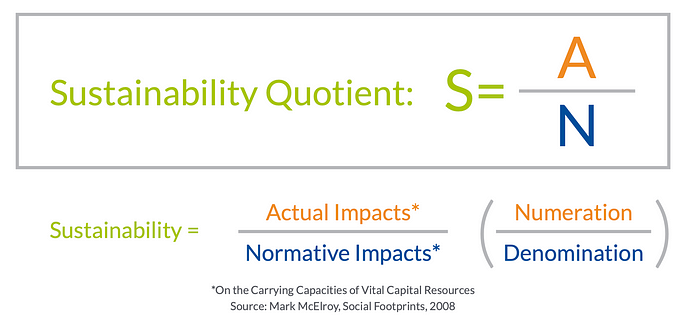

This UNRISD pilot project itself, which launched in January 2021, is another key indicator, with a cohort of a couple dozen companies large and small road testing a three-tiered set of sustainable development performance indicators (SDPIs — see Figure 3 below) that integrated thresholds. The tiers built on — and transcended — existing practice, borrowing the logic of the Sustainability Quotient that r3.0 Advocation Partner Mark McElroy conceived in 2008: Sustainability = Actual Impacts (on the carrying capacities of vital capital resources) / Normative Impacts (on the carrying capacities of vital capital resources). (See Figure 2 below). Think of it as carbon footprint over carbon budget.

UNRISD Three-Tiered Typology of Sustainable Development Performance Indicators

Tier One: Incrementalist Numeration: Numerator indicators focus on actual impacts, including absolute indicator, as well as relative or intensity indicators that are non-normative, and therefore incrementalist by definition.

Tier Two: Contextualised Denomination: Denominator indicators contextualise actual impacts against normative impacts. Also known as “Context-Based” indicators take into account sustainability thresholds in ecological, social, and economic systems, as well as allocations of those thresholds to organizations and other entities.

Tier Three: Activating Transformation: Transformative indicators add the element of implementation and policy to normative denominator indicators to instantiate change within complex adaptive systems.

(From: UNRISD Three-Tiered Typology of Sustainable Development Performance Indicators (Baue, Compared to What? UNRISD, 2019))

UNRISD will release a report on the pilot process along with the new set of indicators in the first quarter of this year, thereby providing a thresholds-based alternative (with the UN imprimatur) to existing standards, which all fall short on the thresholds front:

- The International Sustainability Standards Board (ISSB), the brainchild of the International Financial Reporting Standards (IFRS) Foundation, is prioritizing enterprise value over system value, outside-in over inside-out impacts and risks (see Figure 3below), and incrementalist ESG over thresholds-based sustainability.

- The Global Sustainability Standards Board (GSSB) affiliated with the Global Reporting Initiative (GRI), which is collaborating with the European Financial Reporting Advisory Group (EFRAG) to establish the Corporate Sustainability Reporting Directive (CSRD), has diluted the strength of the thresholds-based Sustainability Context Principle, shifting it from the robust performance standard it has been for its entire 2 decades of existence, into a toothless impact standard, based on an illogical rationale.

We at r3.0 believe that these developments provide the minimal viable platform for triggering the tipping point from the incrementalist mindset into a normative thresholds-based sustainability paradigm.

Transcending Incrementalism

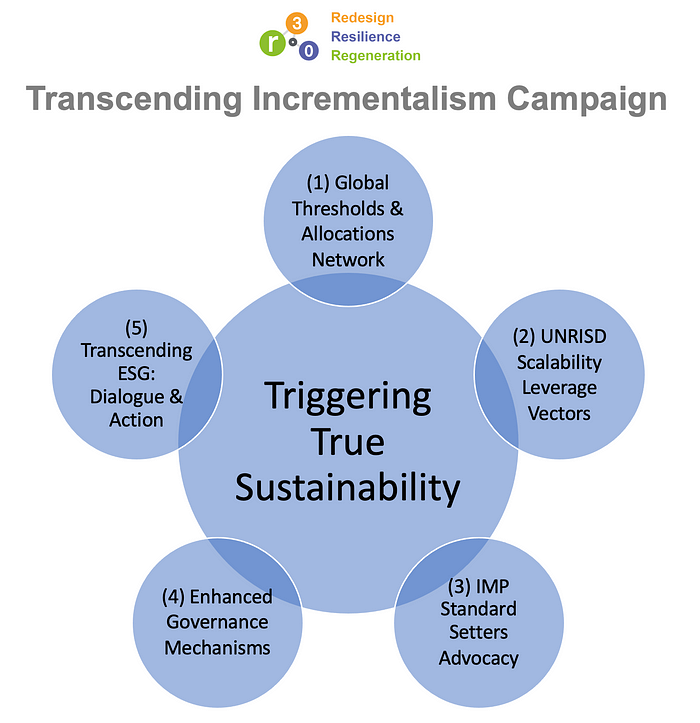

To harness this tipping momentum toward thresholds-based thinking, r3.0 is continuing its norm entrepreneurship by launching a five-pronged campaign on Transcending Incrementalism, encapsulated in the below graphic (see Figure 4).

The flagship of this Campaign is the launch of a Global Thresholds & Allocations Network (GTAN), building on the half-decade of foundational work r3.0 has conducted toward a Global Thresholds & Allocations Council (GTAC). The idea behind the network is to gather together players already active in advancing thinking and practice on thresholds & allocations into a pre-competitive collective to collaborate on field-building and market-making efforts.

Current markets tend toward hostility against thresholds & allocations, punishing market actors who uphold ecological ceilings and social foundations — particularly when those efforts are perceived as obstacles to short-term profits at the enterprise level (ie enterprise value). However, aggregate enterprise-level externalization of impacts onto society generates systemic risks (and indeed existential risks) that accrue to universal investors, so a tipping point toward markets prioritizing system value over enterprise value is inevitable. Given that thresholds & allocations are the key instruments for measuring the creation of system value, actors in the thresholds & allocations ecosystem represent key market makers of emerging exchange systems.

The vision for GTAN is to create a robust ecosystem of players who already play a role in helping govern the Commons of shared vital capital resources that we all rely on for our wellbeing, such as stable regenerative and distributive carbon, water, and wealth cycles. Accordingly, r3.0 is employing the Core Design Principles (CDPs) conceived by Economics Nobel Laureate Elinor Ostrom (in her book Governing the Commons) and stewarded by Prosocial (whose founding president, David Sloan Wilson, helped generalize the CDPs for use by any groups). Prosocial facilitation tools also leverage evolutionary biology of multilevel selection (ie natural selection at the group level) and psychological flexibility to better navigate complexity.

Rather than an endgoal unto itself, the ultimate goal of GTAN is to set foundations for a Global Thresholds & Allocations Council (GTAC), a governance body or mechanism (its form to be determined) for wisely and justly managing our vital capital resources within their carrying capacities, which is unquestionably necessary for navigating the existential predicament we face.

One shift that our GTAN work has inspired is to broaden our conception of GTAC, from a “council” with its more limited and centralized connotations, into a Global Thresholds & Allocations Commons, with its connotations of broadly distributed self-governance. While Ostrom’s work focused on well-bounded communities managing specific common pool resources, a commons-based GTAC would expand this to a globalized purview covering all vital capital resources.

In addition to the flagship GTAN, the Transcending Incrementalism campaign consists of four other components:

Scalability Leverage Vectors (UNRISD)

The final Synthesis Report we wrote for the UNRISD Sustainable Development Performance Indicators (SDPI) pilot project included a set of recommendations for scaling application of the indicators (and the underlying thresholds- & transformation-based thinking) via “leverage vectors” (if the indicators represent one of Dana Meadows’ Leverage Points, then the long “plank” sitting atop this fulcrum represents a “vector” of transformation). The “vectors” are encompassed in Figure 5 below.

Since first presenting this slide to IMP in March 2021, opportunities to address other leverage vectors have arisen, including developing new indicators — for example, r3.0 and CSO are actively collaborating with the Corporate Racial Equity Alliance (CREA) to develop thresholds-based indicators for its Corporate Equity Performance Standards.

Standard Setters Advocacy (IMP)

The Impact Management Platform is creating an “authoritative basis” for guiding reporting standard setters. This basis is predicated on thresholds & allocations, which is currently a gap for the predominant standard setters (as explained above), so r3.0 seeks to both engage with IMP and, as needed, pursue advocacy independent of IMP to encourage standard setters to integrate thresholds & allocations into their standards.

Enhanced Governance Mechanisms

r3.0 has clearly identified governance shortcomings amongst key actors in the sustainability ecosystem, including Public Comment systems that ignore and misrepresent substantive input (as occurred with the GSSB Basis for Conclusions associated with the GRI Universal Standards) as well as embedded conflicts of interest (as is the case with the Science Based Targets initiative (SBTi), which our Senior Director Bill Baue helped instigate in 2012 and submitted a Formal Complaint to its Executive Board that remains unresolved almost a year after submission). Accordingly, we at r3.0 see a dire need to significantly enhance the robustness of governance at key intermediaries in the sustainability ecosystem.

Transcending ESG Dialogues & Action

Finally, the critiques of ESG come from a variety of angles, as do defences of ESG, so we see a ripe opportunity to curate and facilitate dialogue amongst influential voices active in the debate to crystalize the analysis and solution opportunities that can be embraced more collectively.

We are receiving funding and participation asks for the different parts of this campaign and invite you all to consider joining, please contact Ralph or Bill if you are interested:

Celebrating a Decade of r3.0 at our Annual Conference 6/7 September

Clearly, this is an ambitious agenda (we at r3.0 have rarely if ever been accused of being unambitious!), so we consciously schedule our annual Conference about three-quarters of the way through the calendar year, so we can report on progress-to-date on initiatives such as GTAN and our broader Transcending Incrementalism campaigns. Our 9th International r3.0 Conference, at which we celebrate our 10-year anniversary, will take place on 6/7 September 2022. We are actively pursuing a significant shift in how we manage Conference attendance, so please stay tuned, as we anticipate an exciting development when we formally announce our Conference in February, about a half-year before the event.